WHEREAS by Section 84(1) of the Real Estate Act , S.A. 1995, c. R-4.5 (the ” Act “), the Real Estate Council of Alberta (the “Council”) has the power, duty and responsibility to amend or repeal bylaws and rules;

THEREFORE BE IT RESOLVED THAT:

Bylaws 33, 34 and 35 under the Real Estate Act , S.A. 1995, c. R-4.5 shall be amended from

33(1) A notice issued to an industry member by the Executive Director pursuant to subsection 82(1) of the Act shall be in writing and specify

a) the contravention of the provision that the Executive Director believes has occurred;

b) the particulars of the alleged contravention;

c) that payment of the amount set out in the notice will be accepted by the Executive Director as complete satisfaction of the amount of penalty for the alleged contravention and that no further proceedings under Part 6 of the Act will be taken against the person in respect of that contravention;

d) that if the industry member fails to pay the amount set out in the notice in accordance with the requirements set out therein, the Executive Director may commence legal proceedings against the industry member to recover the amount owing in respect of the administrative penalty as a debt due the Council; and

e) that the industry member has the right to appeal the administrative penalty to a Hearing Panel in accordance with section 35 of these bylaws, and that the industry member will be given a full opportunity consistent with procedural fairness and natural justice to present evidence before the Hearing Panel and make representations in relation to the alleged contravention.

(2) A notice under subsection (1) shall be served personally or by single registered mail sent to the latest known address of the industry member to whom the notice relates.

34(1) Subject to subsection (2), an industry member must pay any penalty imposed in accordance with subsection 82(1) of the Act within 30 days of the date on which the Executive Director issued a notice of administrative penalty.

(2) Where the Executive Director is of the opinion that a penalty may cause undue hardship for the industry member who has received a notice of administrative penalty, the Executive Director may extend the time to pay.

35(1) An industry member in respect of whom the Executive Director has issued a notice of administrative penalty may appeal the penalty to a Hearing Panel appointed pursuant to section 36 of the Act.

(2) An appeal under subsection (1) must be commenced by a written notice of appeal, which must

a) describe the administrative penalty appealed, and

b) state the reasons for the appeal.

(3) A notice of appeal under this section must be served on the Executive Director within 30 days after the date on which the notice of administrative penalty is served on the industry member.

(4) An industry member who wishes to appeal an administrative penalty must provide security for costs in the amount of three times the penalty imposed, up to a maximum of $1,000.00, along with the notice of appeal.

(5) On receipt of a notice of appeal and security for costs, the Executive Director shall refer the matter to a Hearing Panel, and on referral of the matter to it, a Hearing Panel shall hold a hearing.

(6) The Hearing Panel must commence to hear an appeal under subsection (5) in accordance with section 41 of the Act, and the rules set out in section 42 of the Act shall apply to the hearing of the appeal.

(7) On an appeal of an administrative penalty, a Hearing Panel may

a) quash, vary or confirm the administrative penalty; and

b) make an award as to the costs of the investigation resulting in the administrative penalty and the appeal.

(8) The decision of the Hearing Panel on an appeal of an administrative penalty shall be final.

to now read:

33(1) A notice issued to a person by the Executive Director pursuant to subsection 82(1) of the Act shall be in writing and specify

a) the contravention of the provision that the Executive Director believes has occurred;

b) the particulars of the alleged contravention;

c) that payment of the amount set out in the notice will be accepted by the Executive Director as complete satisfaction of the amount of penalty for the alleged contravention and that no further proceedings under Part 6 of the Act will be taken against the person in respect of that contravention and that a person who pays an administrative penalty may not be charged under this Act with an offence in respect of that contravention;

d) that if the person fails to pay the amount set out in the notice in accordance with the requirements set out therein, the Executive Director may commence legal proceedings against the person to recover the amount owing in respect of the administrative penalty as a debt due the Council and may charge that person under the Act with an offence in respect of that contravention; and

e) that the person has the right to appeal the administrative penalty to a Hearing Panel in accordance with section 35 of these bylaws, and that the person will be given a full opportunity consistent with procedural fairness and natural justice to present evidence before the Hearing Panel and make representations in relation to the alleged contravention.

(2) A notice under subsection (1) shall be served personally or by single registered mail sent to the latest known address of the person to whom the notice relates.

34(1) Subject to subsection (2), a person must pay any penalty imposed in accordance with subsection 82(1) of the Act within 30 days of the date on which the Executive Director issued a notice of administrative penalty.

(2) Where the Executive Director is of the opinion that a penalty may cause undue hardship for the person who has received a notice of administrative penalty, the Executive Director may extend the time to pay.

35(1) A person in respect of whom the Executive Director has issued a notice of administrative penalty may appeal the penalty to a Hearing Panel appointed pursuant to section 36 of the Act.

(2) An appeal under subsection (1) must be commenced by a written notice of appeal, which must

a) describe the administrative penalty appealed, and

b) state the reasons for the appeal.

(3) A notice of appeal under this section must be served on the Executive Director within 30 days after the date on which the notice of administrative penalty is served on the person.

(4) A person who wishes to appeal an administrative penalty must provide security for costs in the amount of three times the penalty imposed, up to a maximum of $1,000.00, along with the notice of appeal.

(5) On receipt of a notice of appeal and security for costs, the Executive Director shall refer the matter to a Hearing Panel, and on referral of the matter to it, a Hearing Panel shall hold a hearing.

(6) The Hearing Panel must commence to hear an appeal under subsection (5) in accordance with section 41 of the Act, and the rules set out in section 42 of the Act shall apply to the hearing of the appeal.

(7) On an appeal of an administrative penalty, a Hearing Panel may

a) quash, vary or confirm the administrative penalty; and

b) make an award as to the costs of the investigation resulting in the administrative penalty and the appeal.

(8) The decision of the Hearing Panel on an appeal of an administrative penalty shall be final.

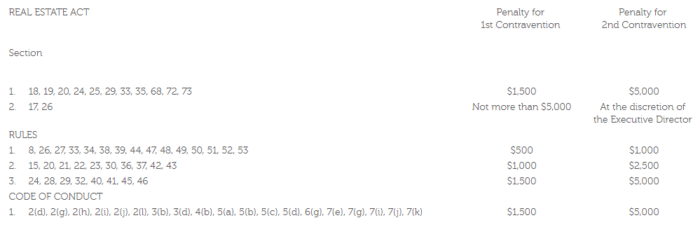

Schedule 1 Administrative Penalties are hereby amended.

Schedule 1 Administrative Penalties

DATED at Edmonton, Alberta on this 8th day of December 1999.