RECA is committed to consulting with stakeholders on strategy, changes to the standards of practice, and other issues that affect the regulation of licensees. Likewise, as a real estate industry leader in Alberta and across Canada, RECA also participates regularly in consultations carried out by other bodies, such as the Alberta government.

The Real Estate Act Rules (Rules) contain most of the requirements affecting licensee business activities, including the licensing structure they operate under, their standards of practice, and most other activities required in order to protect consumers. The current Rules came into effect on October 1, 2006.

Under the Regulatory Excellence priority of its 2022-2025 Strategic Plan, RECA has committed to a comprehensive review of the Rules. Under the direction of the Board-level Rules Review Steering Committee, the Rules Review will be broken out into three stages to ensure stakeholders have opportunities to provide meaningful feedback.

Rules Review Consultation Phase 3 – COMPLETE!

This phase focused on identifying potential issues or unforeseen consequences of adopting the final recommended changes to the Real Estate Act Rules, including their impact on brokerages and industry practices. Your insights were invaluable in shaping the future of industry regulation.

Details on the proposed changes can be found in the Phase 3 Discussion Paper.

Review the verbatim licensee feedback RECA received for Phase 3.

Rules Review Consultation Phase 2, Part 3—COMPLETE!

In Phase 2, Part 3, stakeholders provided feedback on proposed changes to the Real Estate Act Rules 1, 82-118.3, plus Schedules 1–5.

These Rules primarily deal with accounting, records, and reporting, as well as Rules definitions and administrative penalty amounts. The consultation included a Discussion Paper.

These ideas for proposed changes to the Rules are put forward by the Rules Review Steering Committee, a body made up of licensee members from each of RECA’s Industry Councils, and a Chair appointed from the public, after careful consideration of the feedback received in Phase 1 of the Rules Review.

Review the verbatim licensee feedback RECA received for Phase 2, Part 3.

All stakeholders were invited to attend a virtual town hall on this part of the Rules Review.

Town Hall Questions and Comments

Rules Review Consultation Phase 2, Part 2—COMPLETE April 19, 2024!!

In Phase 2, Part 2, stakeholders provided feedback on proposed changes to Real Estate Act Rules, Part 2: Industry Standards of Practice (s.41 to 80.89).

These Rules primarily deal with licensee Standards of Practice, and ideas for potential amendments can be found in the detailed Discussion Paper for this consultation.

Review the verbatim licensee feedback RECA received for Phase 2, Part 2.

RECA held two town halls for this portion of the review. The town halls consisted of a short overview of the proposed ideas, followed by lengthy Q&A sessions.

Town hall questions and comments

Rules Review Consultation Phase 2, Part 1—Completed (November 2023)

For Part 1 of Phase 2, stakeholders provided feedback on proposed changes to Part 1 of the Real Estate Act Rules. These Rules primarily deal with RECA’s licensing framework and notifying RECA of certain events. Further consultations on the rest of the Rules will begin in the coming months.

All respondents were encouraged to review the Discussion Paper for this consultation prior to completing the survey. The proposed changes to the Rules were put forward by the Rules Review Steering Committee, a body made up of licensee members from each of RECA’s Industry Councils, and a Chair appointed from the public, after careful consideration of the feedback received in Phase 1 of the Rules Review.

Review the verbatim feedback RECA received from licensees as part of Phase 2, Part 1.

RECA hosted a Townhall webinar regarding the proposed changes for Part 1 on November 2. View the townhall below. We have also answered all of the questions we couldn’t get to in the Townhall.

Thank you to everyone who took part in the consultation.

Phase 1 of the Rules Review Consultation closed May 9, 2023. Download the Phase 1 discussion paper for more information.

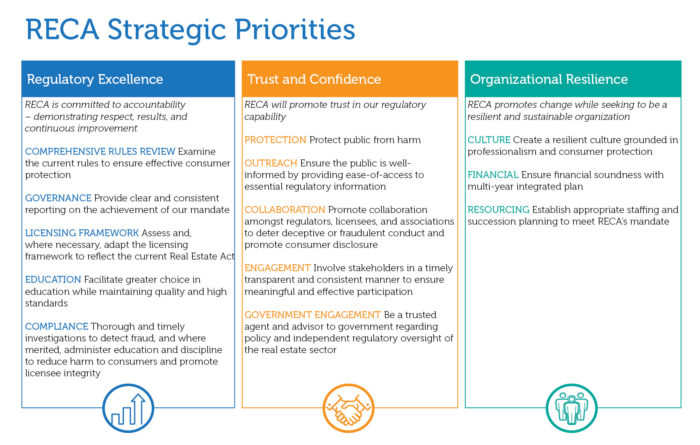

From November 2021 to January 2022, RECA stakeholders like you, provided their thoughts on what trends, issues, and challenges they see in their industry now, and what they see coming in the future. Through this opportunity, stakeholders informed RECA of regulatory matters it should be focusing on, where red tape could be reduced, and the relevancy of RECA’s past strategic priorities. After carefully considering input from licensees, trade associations, consumers, government, and each of the four Industry Councils, RECA’s Board developed three broad strategic priorities that will inform the RECA 2022-25 Strategic Plan.

Stakeholder feedback throughout the strategic planning process has led directly to the proposed priorities. Stakeholders were able to provide thoughts on the proposed priorities between April and June 2022.

The Board and all of RECA are committed to meaningful engagement with all stakeholders, and RECA will communicate with all stakeholders immediately when the 2022-25 Strategic Plan becomes available. RECA will also communicate how the feedback in this survey, and throughout the strategic planning process, impacted RECA’s strategic direction, and its role as a regulator.

All stakeholder engagement conducted by RECA will follow the Stakeholder Engagement Policy. The Board believes strongly that all engagement must be timely, meaningful, consistent, equal, transparent, and effective.

Thank you for taking the time to participate in self-regulation. It is a privilege that only works when stakeholders take part, and when their voices are heard.

RECA’s industry councils collected feedback from brokers and associate brokers on proposed competencies for real estate brokers.

Why stakeholder input matters

Your feedback is an opportunity to participate in self-regulation. Taking the time to provide feedback in this consultation helped set the standards the industry will follow for years to come.

The survey closed on November 16, 2021. Review the approved Real Estate Broker Competency Profile

About the competencies

A competency is a combination of skills, knowledge, attitudes, and behaviours needed to perform a particular activity to accepted standards. A real estate broker must first meet the associate competencies for their sector (commercial, residential, rural, and/or property management) before meeting the broker competencies.

The competencies were drafted by the following industry councils:

On behalf of RECA’s industry councils, THANK YOU for taking the time to provide your feedback. Your experience is invaluable and your opinion is crucial in developing competencies that will support Alberta’s industry for many years to come.

RECA’s Mortgage Broker Industry Council wants your feedback on proposed competencies for mortgage brokers.

Why stakeholder input matters

Your feedback is an opportunity to participate in self-regulation. Taking the time to provide feedback helped set the standards the industry will follow for years to come.

The survey closed on November 12, 2021. Review the approved Mortgage Broker Competency Profile.

A competency is a combination of skills, knowledge, attitudes, and behaviours needed to perform a particular activity to accepted standards. The competencies will be used by a variety of stakeholders in a variety of ways, including but not limited to:

On behalf of RECA’s Industry Council, THANK YOU for taking the time to provide your feedback. Your experience is invaluable and your opinion is crucial in developing competencies that will support Alberta’s industry for many years to come.

RECA’s Mortgage Broker Industry Council wants your feedback on proposed competencies for mortgage associates.

Why stakeholder input matters

Your feedback is an opportunity to participate in self-regulation. Taking the time to provide feedback helped set the standards the industry will follow for years to come.

The survey closed on November 8, 2021. Review the approved Mortgage Associate Competency Profile.

A competency is a combination of skills, knowledge, attitudes, and behaviours needed to perform a particular activity to accepted standards. The competencies will be used by a variety of stakeholders in a variety of ways, including but not limited to:

On behalf of RECA’s Industry Council, THANK YOU for taking the time to provide your feedback. Your experience is invaluable and your opinion is crucial in developing competencies that will support Alberta’s industry for many years to come.

RECA’s Residential Real Estate Broker Industry Council wants your feedback on proposed competencies for residential real estate associates.

Why do we need your feedback?

Providing your feedback is an opportunity to participate in self-regulation. Taking the time to provide feedback helped set the standards the industry will follow for years to come.

A competency is a combination of skills, knowledge, attitudes, and behaviours needed to perform a particular activity to accepted standards. The competencies will be used by a variety of stakeholders in a variety of ways, including but not limited to:

RECA’s Industry Council would like to thank you for taking the time to provide your feedback. Your experience is invaluable and your opinion is crucial in developing competencies that will support Alberta’s industry for many years to come.

RECA’s Residential Property Manager Industry Council and Commercial Real Estate Broker and Commercial Property Manager Industry Council have drafted competencies for residential and commercial property management associates in Alberta, and they want your feedback on them.

A competency is a combination of skills, knowledge, attitudes, and behaviours needed to perform a particular activity to accepted standards.

Why do we need stakeholder feedback?

Providing your feedback is an opportunity to participate in self-regulation and help set the standards the industry will follow for years to come. The competencies will be used by a variety of stakeholders in a variety of ways, including but not limited to:

This input opportunity closed on October 25, 2021. Review the approved Property Manager Associate Competency Profile.

RECA’s Industry Councils would like to thank you for taking the time to provide your feedback. Your experience is invaluable and your opinion is crucial in developing competencies that will support Alberta’s industry for many years to come.

Stakeholders were invited to provide feedback on RECA’s proposed Pre-Licensing Education Philosophy, Course and Course Provider Requirements, and Examination Blueprint.

This feedback was crucial for setting the requirements for third-party course providers to apply to offer pre-licensing education to real estate, mortgage, property management, and condominium management licensees in Alberta.

Survey

RECA collected feedback on three documents:

Pre-Licensing Education Philosophy

Course and Course Provider Requirements

Examination Blueprint for Education

This consultation closed on June 11, 2021.

RECA will considered all feedback before finalizing these documents. These documents are the basis for potential course providers to become recognized by RECA as being able to deliver licensing education courses in Alberta.

Consultation on Proposed Standards of Practice for Condominium Managers has closed. Thank you for participating! RECA is currently reviewing the feedback received. Updates will be provided once the data has been compiled.

Appendix A: Proposed Condominium Manager Rules With New Sections Highlighted

Appendix B: Summary of Proposed Condominium Manager Rules

Appendix C: Proposed Mandatory Content for Service Agreements

In June 2020 the Condominium Manager Implementation Advisory Committee finalized the proposed Standards of Practice and sent them to the RECA Administrator for approval to go forward with the public consultation. In June 2020 the Administrator approved the consultation.

The Advisory Committee met four times between January and June of 2019 to finalize the draft Standards of Practice for condominium managers.

The Condominium Manager Implementation Advisory Committee paused their meetings until Service Alberta finalized the regulations under the Condominium Property Amendment Act. In December 2019 Service Alberta announced the revised regulations would be effective January 1, 2020.

On June 27, 2019, Service Alberta announced the condominium regulations will be paused for six months for a red tape review.

RECA continues preparations for consultation on and implementation of Real Estate Act amendments for the regulation of condominium managers, and will be ready to consult with stakeholders once the Government of Alberta completes the Regulations under the Condominium Property Amendment Act.

RECA’s Condominium Manager Implementation Advisory Committee met on February 20, 2018 to review the status of RECA’s project.

On December 14, 2018 the Government of Alberta announced the second stage of regulation changes to the Condominium Property Amendment Act and announced they will begin stage three consultation. RECA will be doing a separate consultation specifically on condominium manager licensing. For more information, contact Doug Dixon, Real Estate Regulatory Compliance Advisor at: DDixon@reca.ca.

If you would like information about the Government of Alberta’s progress on CPAA Regulations, please visit the Service Alberta website.

Condominium Manager Regulation Consultation (Phase 1, Complete)

In December 2014, the Government of Alberta passed legislation that will require licensing for condominium managers. When the legislation takes effect, the Real Estate Council of Alberta (RECA) will be responsible for setting standards, licensing and regulating individuals who provide condominium management services.

In fall 2015, RECA launched a consultation to gather feedback from condominium industry stakeholders, including condominium managers, boards, owners and consumers on the proposed regulatory model for condominium managers. That consultation process included a consultation paper and town-hall meetings in Medicine Hat, Lethbridge, Ft. McMurray, Lloydminster, Edmonton, Edson, Grande Prairie, Calgary and Red Deer. Stakeholders were invited to respond to the consultation paper in writing by December 9, 2015 and attend one or more of the town hall meetings.

Results from Phase 1 consultation: Council approved a Regulatory Model for Condominium Managers.

The Real Estate Council of Alberta’s (RECA) Condominium Manager Implementation Advisory Committee (CMIAC) recently completed Phase 1 of the Condominium Manager Regulation Consultation. As a result of this consultation, CMIAC provided, and Council approved, recommendations in six areas:

Licensing recommendations

Education recommendations

Trust account audit & review program recommendations

Professional liability insurance recommendation

Unlicensed condominium manager activity and licensed condominium manager misconduct recommendation

The Mortgage Rule Changes were put on hold as RECA underwent changes in legislative authority and governance in 2019-2020.

RECA is proposing changes to the Real Estate Act Rules regarding mortgage broker standards of practice. RECA is proposing:

More information is in the Consultation Paper: Proposed Changes to REA Rules – Mortgage Broker Standards of Practice.

In March 2019, RECA completed a consultation about the Consequences of the Current Methodology for Measuring Semi-detached and Attached Properties. The feedback Council received from this consultation ranged considerably, but several key consequences were identified. These included the potential for under-insured, under-valued, and under-appraised properties, that some properties may be refused financing, and that there was a lack of clarity and consistency for consumers.

Council created an ad hoc committee which met in May and June 2019. In July, the committee recommended proposed amendments to the RMS.

More information is the Consultation Paper: Proposed Modification to the Residential Measurement Standard. The consultation closed on September 16, 2019.

From April 15 – July 15, 2019, RECA consulted on the feasibility of graduated licensing as a means to address the shortage of property management professionals. Property management brokerages have indicated to RECA that they have difficulty attracting individuals to enter the property management profession. The shortage of property management professionals could result in existing professionals being overworked, not completing their responsibilities or taking shortcuts. It also can result in unlicensed activities. These situations place the public at risk and have the potential to undermine the integrity of the profession.

The Consultation Paper contains important information about the scope of this consultation.

From January 18, 2019 until March 18, 2019 RECA held a consultation about the Residential Measurement Standard (RMS). At the October 2018 Council meeting, Council directed RECA to consult with stakeholders about the potential consequences of the current RMS methodology for measuring semi-detached and attached properties. The current methodology is measuring interior perimeter walls at floor level (paint-to-paint). More information is within the RMS Consequences Consultation Paper.

The Real Estate Council of Alberta (RECA) is reviewing mortgage brokerage standards and Rules to enhance consumer protection, ensure our standards of practice are strong, and to document current practices in the mortgage brokerage industry. We want to know what our stakeholders think of the proposed changes.

In February 2018, RECA posted the Mortgage Brokerage Proposed Standards of Practice and Rule Changes Consultation Paper. The formal consultation period for this initiative ended on May 9, 2018. RECA is reviewing the feedback it received. Please watch for future updates.

In June 2018, the Mortgage Brokers’ Advisory Committee met to review the feedback from the consultation survey, town hall meetings, and written submissions. After the June meeting, RECA staff and a subcommittee began adjusting the original proposals to reflect the feedback received while remaining consistent with the original objectives. The MBAC will meet again, in the Fall of 2018, to consider the revisions and determine next steps.

In December 2014, the Government of Alberta passed legislation that will require licensing for condominium managers. When the legislation takes effect, the Real Estate Council of Alberta (RECA) will be responsible for setting standards, licensing and regulating individuals who provide condominium management services.

In fall 2015, RECA launched a consultation to gather feedback from condominium industry stakeholders, including condominium managers, boards, owners and consumers on the proposed regulatory model for condominium managers. That consultation process included a consultation paper and town-hall meetings in Medicine Hat, Lethbridge, Ft. McMurray, Lloydminster, Edmonton, Edson, Grande Prairie, Calgary and Red Deer. Stakeholders were invited to respond to the consultation paper in writing by December 9, 2015 and attend one or more of the town hall meetings.

Results from Phase 1 consultation: Council approved a Regulatory Model for Condominium Managers.

The Real Estate Council of Alberta’s (RECA) Condominium Manager Implementation Advisory Committee (CMIAC) recently completed Phase 1 of the Condominium Manager Regulation Consultation. As a result of this consultation, CMIAC provided, and Council approved, recommendations in six areas:

Education recommendations

Bonding or real estate assurance fund recommendation

Trust account audit & review program recommendations

Professional liability insurance recommendation

Unlicensed condominium manager activity and licensed condominium manager misconduct recommendation

RECA’s consultation on and implementation of Real Estate Act amendments for the regulation of condominium managers has been on hold pending the Government of Alberta’s completion of Regulations under the Condominium Property Amendment Act.

RECA’s Condominium Manager Implementation Advisory Committee met on February 20, 2018 to review the status of RECA’s project.

On December 14, 2018 the Government of Alberta announced the second stage of regulation changes to the Condominium Property Amendment Act and announced they will begin stage three consultation which includes condominium manager licensing. For more information, contact Doug Dixon, Real Estate Practice Advisor: DDixon@reca.ca.

If you would like information about the Government of Alberta’s progress on CPAA Regulations, please visit the Service Alberta website at: http://www.servicealberta.ca/Consumer-condominiums.cfm.

RECA is proposing amendments to the Real Estate Act Rules that would allow brokerages to deposit funds in a brokerage “other account.” This account could be used to segregate commissions from which a brokerage could pay professionals’ commissions. If a brokerage sets up the other account as a brokerage trust account, this trust account would not be a RECA-regulated trust account and it could not hold consumer deposits.

The proposed amendments would also clarify that the Real Estate Assurance Fund was and is intended as a consumer protection fund for consumers only.

Openness and Transparency (complete)

Residential Measurement Standard (complete)

The Real Estate Council of Alberta (RECA) undertook a comprehensive review of the Real Estate Act in late 2012 prior to beginning consultation with a wider group of stakeholders. Some of the amendments RECA put forward in its first consultation paper (December 2012) were not ultimately put forward to the Government of Alberta as a result of feedback from industry professionals.

At a high level, the amendments RECA has put forward focus on:

For more information on the recommendations put forward by RECA, click here.

To read the Consultation Report on the Real Estate Act amendments submitted to Service Alberta, click here.

While the Government of Alberta had originally indicated the Real Estate Amendment Act would be scheduled on the legislative agenda for the Spring 2014 sitting of the Legislature, legislative priorities have since changed and it is unclear when this Act may move forward.